Comparing Safe-Haven Assets: Gold, Annuities, and Treasuries

Understanding Safe-Haven Assets

In times of economic uncertainty, investors often turn to safe-haven assets to preserve their wealth. Among the most popular choices are gold, annuities, and treasuries. Each of these options comes with its unique benefits and drawbacks, making it essential for investors to understand their differences.

Safe-haven assets are investments known for their stability and low risk, especially during volatile market conditions. They serve as a financial cushion, helping investors protect their portfolios from significant losses.

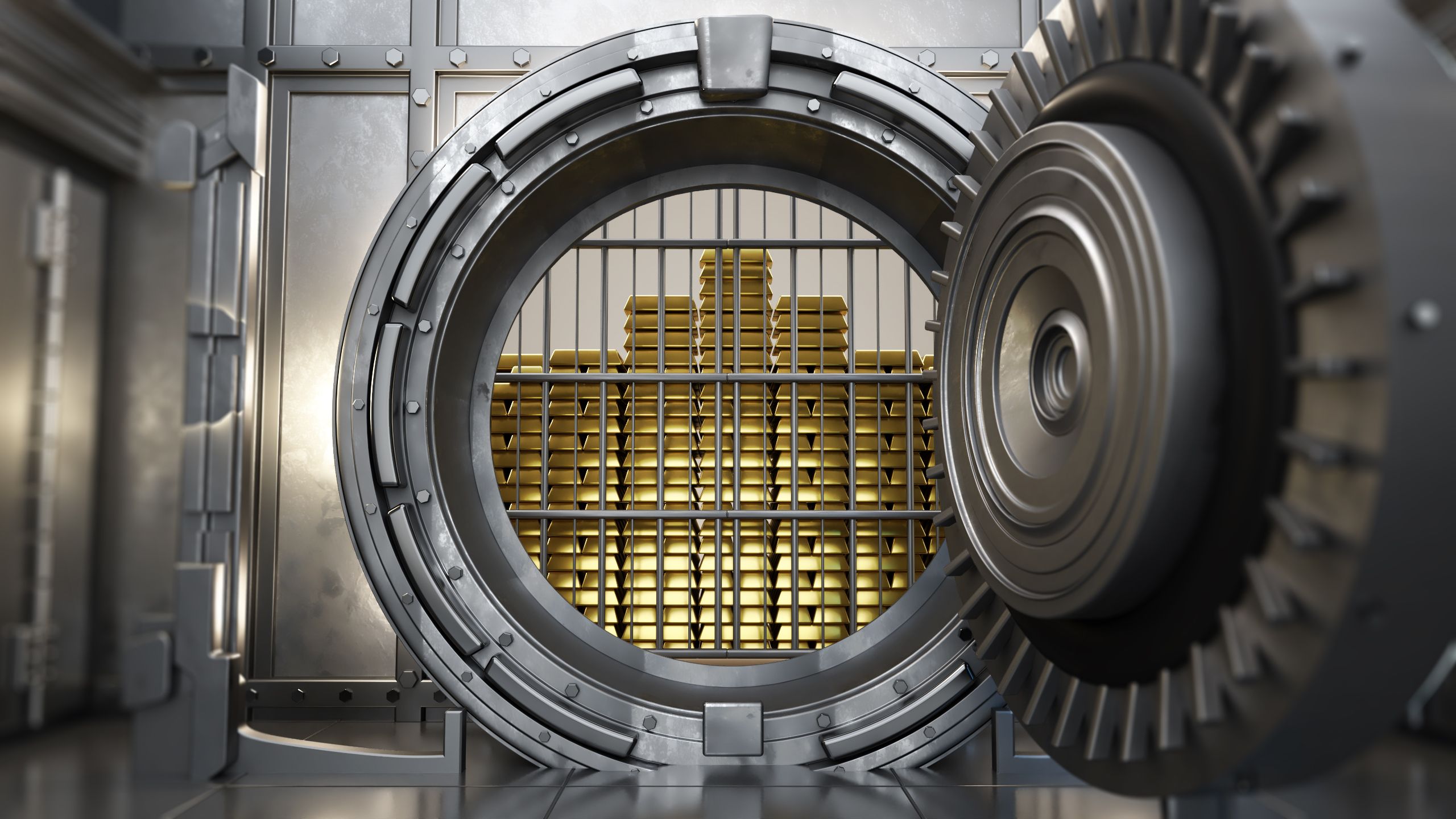

Gold: The Timeless Asset

Gold has been a symbol of wealth and stability for centuries. Known for its physical properties and intrinsic value, gold is often considered a hedge against inflation and currency devaluation. Investors typically appreciate gold for its ability to maintain value over long periods.

However, investing in gold comes with its own set of challenges. While it can protect against inflation, it doesn't provide income like dividends or interest. Additionally, the price of gold can be volatile in the short term, influenced by geopolitical events and market sentiment.

Annuities: Guaranteed Income

Annuities are financial products that guarantee a steady income stream, making them an attractive option for retirees. By purchasing an annuity, investors can ensure a fixed income for a specified period or even for life. This predictability makes annuities a reliable choice for long-term financial planning.

However, annuities are not without downsides. They can be complex, with various types offering different benefits and restrictions. Annuities often come with fees and penalties, and their returns may not keep pace with inflation, potentially eroding purchasing power over time.

Treasuries: Government-Backed Security

Treasuries are government-issued securities that are highly regarded for their safety and liquidity. Backed by the full faith and credit of the issuing government, they are considered one of the safest investments available. Treasuries come in various forms, including bills, notes, and bonds, each with different maturities and interest rates.

While treasuries provide a reliable return, their yields are typically lower than other investments. This low return can be a disadvantage in periods of high inflation, where the purchasing power of returns diminishes.

Choosing the Right Safe-Haven Asset

When selecting a safe-haven asset, investors should consider their financial goals, risk tolerance, and investment horizon. Each asset class offers distinct advantages and limitations, making it crucial to align choices with personal financial objectives.

For those seeking long-term stability and a hedge against inflation, gold may be a suitable choice. Annuities can provide a secure income stream, ideal for retirement planning. Treasuries offer unparalleled safety and liquidity, appealing to risk-averse investors.

Conclusion

Gold, annuities, and treasuries each play a vital role in a diversified investment strategy. By understanding their characteristics and evaluating personal financial needs, investors can make informed decisions to safeguard their wealth. Consider consulting with a financial advisor to tailor a strategy that best fits your unique circumstances.