Gold IRAs: A Popular Choice for Portfolio Diversification

Understanding Gold IRAs

Gold Individual Retirement Accounts (IRAs) have gained popularity as a strategic choice for those looking to diversify their investment portfolios. By allowing investors to hold physical gold, these accounts provide a hedge against economic uncertainty and inflation. Unlike traditional IRAs, which typically hold paper assets, Gold IRAs offer a tangible investment option.

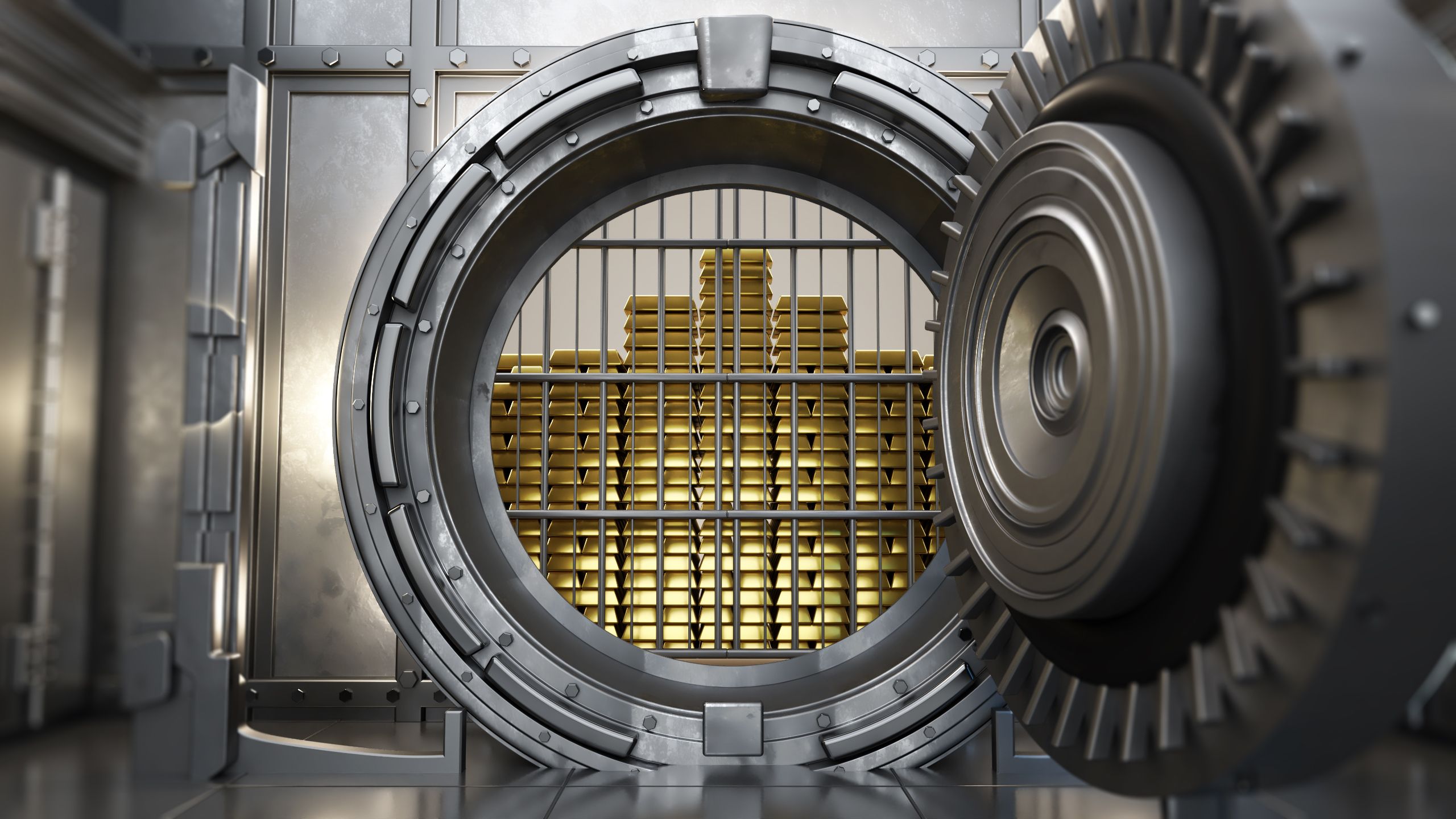

Investing in a Gold IRA involves purchasing physical gold, such as coins or bars, and storing them in an approved depository. This tangible asset can provide peace of mind in volatile markets. The value of gold often moves inversely to the stock market, making it an attractive option for those seeking stability.

Benefits of Gold IRAs

There are several benefits to incorporating Gold IRAs into your investment strategy. Here are some key advantages:

- Diversification: Gold provides diversification, reducing the risk associated with paper assets.

- Inflation Hedge: Historically, gold has been a reliable hedge against inflation, preserving purchasing power.

- Safe Haven: During economic downturns, gold often retains its value, providing security.

How to Set Up a Gold IRA

Setting up a Gold IRA is relatively straightforward but involves several steps. First, choose a reputable custodian who specializes in Gold IRAs. They will guide you through the process and help you comply with IRS regulations. It's essential to ensure that the custodian is approved to handle precious metals.

Next, decide on the type of gold you want to invest in. Options include gold coins, bars, and bullion. Each type has its considerations, such as liquidity and storage costs. Once you select your gold, your custodian will facilitate the purchase and arrange secure storage in an approved facility.

Considerations and Risks

While Gold IRAs offer numerous benefits, it's crucial to be aware of potential risks. The price of gold can be volatile, and while it often acts as a hedge against inflation, it doesn't guarantee profits. Additionally, there are costs associated with storage and insurance that should be factored into your decision.

It's also important to understand the tax implications. Gold IRAs are subject to the same rules as traditional IRAs, including contribution limits and required minimum distributions (RMDs). Consulting with a financial advisor can provide personalized insights based on your financial goals.

Conclusion

Gold IRAs can be a valuable addition to an investment portfolio, offering diversification, protection against inflation, and a safe haven during economic turbulence. By understanding the benefits and risks, and by working with a knowledgeable custodian, investors can make informed decisions that align with their financial objectives.

As with any investment, due diligence and careful planning are essential. Gold IRAs are not a one-size-fits-all solution, but they can play a significant role in strengthening your retirement strategy.