Why Retirees Prefer Physical Gold Over Paper Assets

The Allure of Tangibility

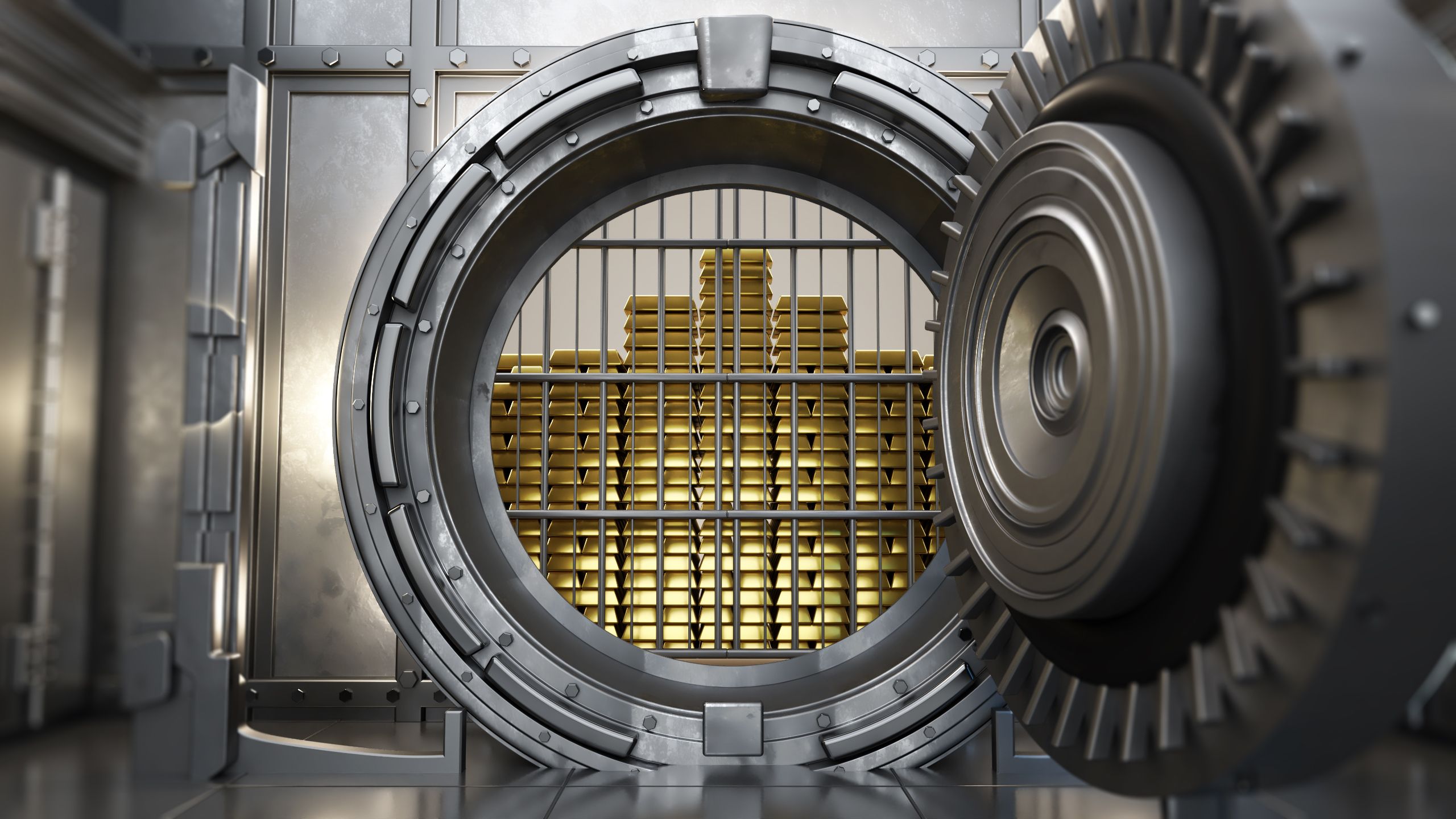

In an era where digital and paper assets dominate the financial landscape, many retirees are turning to physical gold as a reliable investment. The allure of gold lies in its tangible nature, providing a sense of security that paper assets often lack. For those who have spent a lifetime building their nest egg, the physical presence of gold can offer peace of mind.

Hedge Against Inflation

One of the primary reasons retirees prefer gold is its ability to act as a hedge against inflation. Unlike paper assets, whose value can be eroded by economic fluctuations, gold tends to retain its value, or even appreciate, during inflationary periods. This makes it an attractive option for those looking to preserve their purchasing power in retirement.

Stability in Uncertain Times

Gold is often seen as a safe haven during times of economic uncertainty. While stocks and bonds may experience volatility, gold typically remains stable. This reliability is particularly appealing to retirees who prefer to avoid the stress of market fluctuations and focus on enjoying their golden years.

Diversification Benefits

Diversification is a key principle of smart investing, and gold plays a crucial role in a well-rounded portfolio. By including gold, retirees can reduce their exposure to risk and enhance the overall stability of their investments. This diversification can help protect their financial future from unforeseen market events.

Limited Supply and High Demand

Gold's value is also supported by its limited supply and the continuous demand from various sectors, including technology and jewelry. As a finite resource, gold can offer retirees a unique advantage over paper assets, which can be more susceptible to market saturation and devaluation.

Legacy and Inheritance

For many retirees, gold serves as a legacy. It’s not just about securing their future but also about leaving something tangible for their heirs. Unlike paper assets that might be tied up in complex legal processes, gold can be easily passed down through generations, maintaining its value and significance.

Conclusion

In conclusion, the preference for physical gold among retirees is driven by its tangible nature, stability, and ability to act as a hedge against inflation. As they plan for the future, retirees find comfort in the knowledge that gold can offer a reliable and enduring investment. Whether for diversification, legacy, or simply peace of mind, gold remains a favored choice for those navigating the complexities of retirement planning.